Vietnam is expected to show annualized growth of 6.3% in the fourth quarter when it releases the data sometime next week.

That would be the first slowdown in annual growth since 2012 and below the 7% growth that was expected by Prime Minister Nguyen Tan Dung.

The slowdown reflects the impact of the worst drought in nearly 100 years. And while growth is likely to pick back up, according to Capital Economics, Vietnam could be “sowing the seeds of the next crisis” with its loose monetary policy.

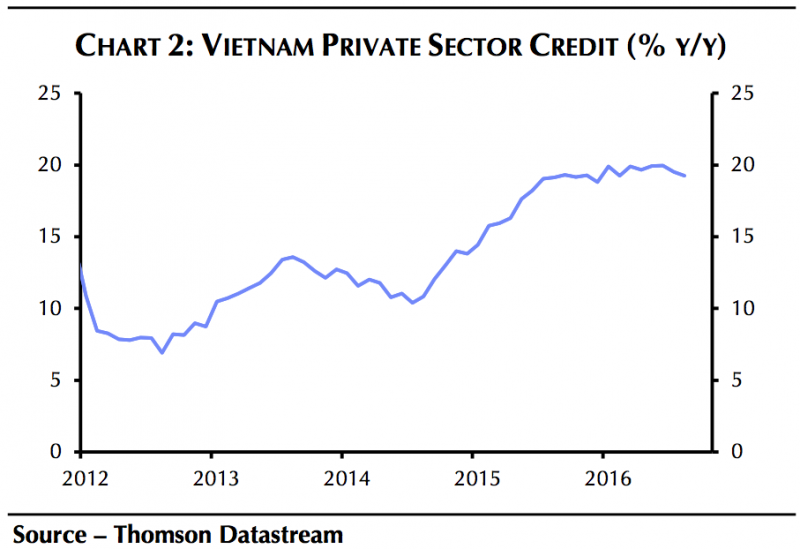

Private-sector credit is on track to grow at near 20% for 2016, and in a note sent out to clients on Friday, Capital Economics senior Asia economist Gareth Leather wrote that “a credit boom on the scale that Vietnam is experiencing is not sustainable over the long term” and that another spike in nonperforming loans seemed “inevitable.”

To make matters worse, the country's banking system has yet to fully recover from its 2011 crisis. That's when Vietnam's state-owned shipping company, Vinashin, went belly up.

That's not the only thing working against Vietnam. The country's exports have averaged growth of 12% to 14% from 2000 to 2016 but came in at just 7.5% for the first 11 months of 2016, according to Credit Suisse. And the boost that was expected to come from the Trans-Pacific Partnership probably won't be as robust as initially thought because President-elect Donald Trump has vowed that the US will not take part in the deal.

As a result, Deepali Bhargava, an Asia economist at Credit Suisse, says the shift in US policy poses three risks to Vietnam's economy.

First, the country's currency, the dong, is likely to depreciate by 4% to 5% next year. Second, a slowdown in global investment is likely to weigh on trade. Finally, there's a risk that reforms will be delayed because of the likely demise of TPP.

Still, despite these headwinds, both Capital Economics and Credit Suisse think 2017 will still be another solid year for the Vietnamese economy. Capital Economics expects growth of 7% in 2017, while Credit Suisse sees growth of 6.2%.

"Robust export growth and an acceleration in private consumption due to a recovery in farm incomes should offset the lackluster government spending and likely slowdown in credit growth," Bhargava wrote.